glennahutton89

About glennahutton89

No Credit Test Loans for Dangerous Credit Score: A Comprehensive Information

In today’s monetary landscape, many individuals face challenges relating to securing loans on account of poor credit histories. If you have any type of inquiries concerning where and how to make use of fast easy no credit check payday loans (simply click the next web page), you can call us at our web site. Traditional lenders usually rely closely on credit score scores to find out eligibility, leaving these with unhealthy credit feeling hopeless. Nevertheless, no credit score verify loans have emerged as an alternative for borrowers who need instant monetary assistance without the burden of credit scrutiny. This text explores what no credit score test loans are, their benefits, potential dangers, and tips for securing one.

Understanding No Credit Verify Loans

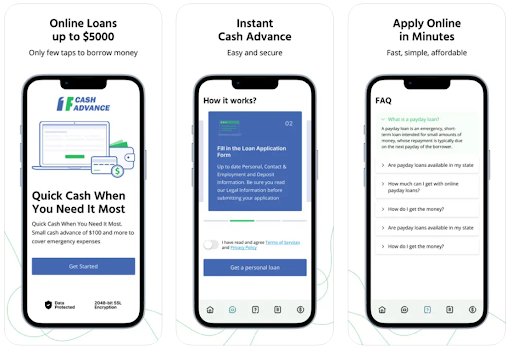

No credit score test loans are monetary merchandise provided by lenders that do not require borrowers to endure a credit score verify as a part of the application course of. This means that even people with unhealthy credit histories or no credit score at all can qualify for these loans. They are sometimes marketed to those who need fast money for emergencies, unexpected bills, or to cover bills.

These loans can are available various kinds, together with payday loans, private loans, and installment loans. Whereas the specifics can range by lender, the elemental characteristic remains the identical: an absence of credit rating evaluation.

Types of No Credit score Test Loans

- Payday Loans: These are short-time period, high-interest loans sometimes due on the borrower’s subsequent payday. They are sometimes easy to acquire but include high fees and curiosity charges.

- Installment Loans: Not like payday loans, installment loans enable borrowers to pay back the mortgage in fixed month-to-month funds over an extended interval. They could have barely lower interest rates in comparison with payday loans.

- Title Loans: These loans require borrowers to make use of their car as collateral. If the borrower fails to repay, the lender can repossess the car.

- Peer-to-Peer Loans: Some on-line platforms connect borrowers with individual buyers prepared to lend money with out performing a credit test. This can be a viable possibility for these with bad credit score.

Advantages of No Credit Check Loans

- Quick Approval Process: One of the most important advantages of no credit verify loans is the speed at which borrowers can obtain funds. Many lenders offer prompt approvals, allowing individuals to entry cash within hours.

- Accessibility: These loans are designed for individuals with poor credit histories, making them extra accessible than traditional loans.

- Flexible Use: Borrowers can use the funds for various functions, including medical bills, car repairs, or unexpected bills.

- No Affect on Credit Score: Since these loans do not involve a credit check, they don’t affect the borrower’s credit score throughout the appliance course of.

Potential Risks of No Credit Examine Loans

While no credit test loans could seem like a lifeline for these in financial distress, they come with inherent risks that borrowers ought to rigorously consider:

- Excessive-Curiosity Rates: No credit score verify loans often carry exorbitant curiosity rates compared to traditional loans. Borrowers may end up paying significantly greater than they borrowed.

- Brief Repayment Phrases: Many no credit check loans, particularly payday loans, have quick repayment periods. This will create a cycle of debt if borrowers are unable to repay on time and must take out additional loans to cover the primary.

- Potential for Predatory Lending: Some lenders may interact in predatory practices, focusing on susceptible people with hidden charges and unfavorable terms. It is crucial to research lenders and skim the effective print before agreeing to any loan.

- Risk of Shedding Collateral: For secured loans like title loans, borrowers threat shedding their collateral (e.g., their vehicle) if they cannot repay the mortgage.

Tips for Securing a No Credit Verify Mortgage

If you end up in a situation the place a no credit score check loan is important, consider the following suggestions to ensure you make an knowledgeable resolution:

- Analysis Lenders: Not all lenders are created equal. Look for respected lenders with positive reviews and clear phrases. Keep away from those with a historical past of complaints or hidden charges.

- Read the Effective Print: Before signing any agreement, carefully evaluate the terms and circumstances. Perceive the interest rates, charges, and repayment schedule.

- Borrow Solely What You Need: It may be tempting to borrow more than mandatory, but this can result in increased repayment amounts. Only borrow what you’ll be able to realistically afford to pay back.

- Consider Alternate options: Discover other options before committing to a no credit check loan. This might embrace borrowing from friends or family, negotiating cost plans with creditors, or looking for assistance from native charities or non-earnings.

- Create a Repayment Plan: Before taking out a loan, develop a transparent plan for how you will repay it. Consider your month-to-month price range and ensure you can accommodate the loan payments.

Conclusion

No credit score test loans can provide a viable resolution for people with dangerous credit looking for quick monetary relief. Nonetheless, they come with vital risks that should not be ignored. By understanding the types of no credit score examine loans obtainable, their benefits, and the potential pitfalls, borrowers could make informed selections that align with their financial situations. At all times prioritize responsible borrowing and explore all accessible options to keep away from falling right into a cycle of debt. With cautious planning and research, it is possible to navigate the world of no credit examine loans and emerge with a better financial outlook.

No listing found.